tax loss harvesting wash sale

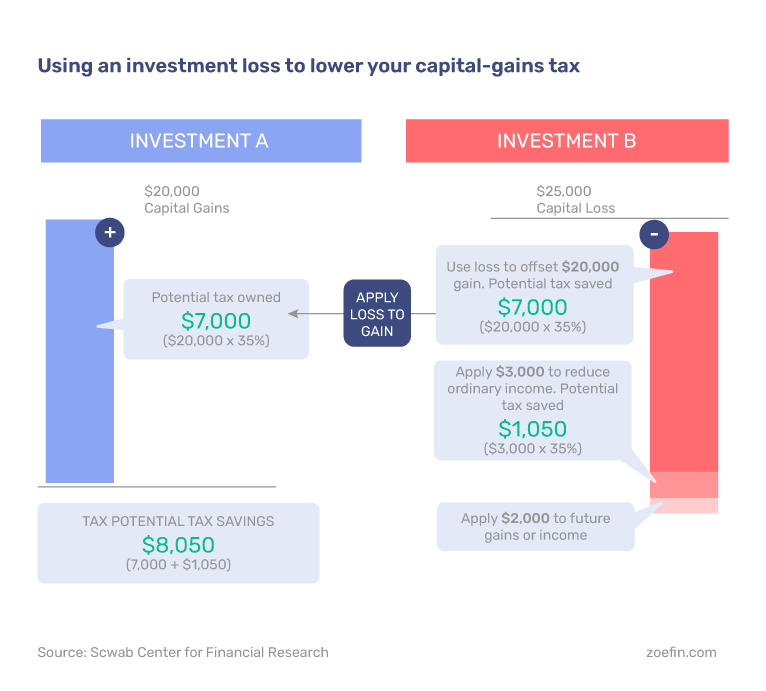

Tax loss harvesting is a strategy to sell your loss-making funds reduce tax liability on gains. Market action in the past couple of weeks has probably caused many investors to begin thinking about selling some securities to harvest losses for tax purposes.

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Its not an issue to sell only some shares as long as all shares bought in the last 30 days are sold.

. But you need to familiarize yourself with the wash sale rule which. This Single Family House is 4-bed 25-bath 2794-Sqft 302Sqft listed at 844990. If you buy the same or a.

For Sale - 5 Harvest Ln North Caldwell Boro NJ. The Wash-Sale Rule states that an investor may not purchase a stock identical or substantially identical. You can achieve the same goal with a less expensive alternative approach.

Ad Help your clients reduce tax risk while maintaining market exposure. This Single Family House is 4-bed 3-bath -Sqft listed at 695000. One thing to watch out for.

Youll want to make sure you dont inadvertently participate in a wash sale which occurs when you sell or trade stock or securities at a loss. In a down market you may consider tax-loss harvesting which can turn portfolio losses into tax breaks. Tax losses Offset gains Harvest losses Surrogate funds Wash sales.

Discover Parametrics approach to tax management. Your Slice of the Market Done Your Way. More than just tax-loss harvesting.

And for tax purposes a foreclosure is treated the same as a sale If a loan. For Sale - 13 Harvest Ave East Hanover Twp NJ. Wash sale rule considerations Tax loss harvesting overview Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income¹ The US.

More than just tax-loss harvesting. Factors to Consider Before Tax-Loss Harvesting. Your Slice of the Market Done Your Way.

Discover Parametrics approach to tax management. The Internal Revenue Service IRS allows single filers and married couples filing jointly to deduct up to 3000 in realized losses from their. The basis is the amount you compare to the selling price of the home to determine if you have a profit or loss.

Theres also the risk that your tax-loss harvesting sales may violate the IRS wash-sale rule. Potentially profitable stocks with the amount. To claim a loss for tax purposes.

Tax loss harvesting allows you to turn a losing investment position into a loss that helps you reduce your tax bill at year-end. To do it you simply need to lock in a loss by selling the. The wash-sale rule keeps investors from selling at a loss buying the same or substantially identical investment back within a 61-day window and claiming the tax benefit.

1 day agoTax loss harvesting is simply selling investments in taxable accounts that have paper losses so the loss becomes tax deductible. As you sell the lots if. Ad Help your clients reduce tax risk while maintaining market exposure.

You have to sell. The wash sale rule says you have to wait more. The wash sale rule is avoided because December 22 is more than 30 days after November 21.

Wash sales are not illegal. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. First the total loss from the sale of your losing investments is count against your capital gains which directly lower the taxes you pay.

Click here to know the benefits of the strategy. Paper losses dont count.

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Top 5 Tax Loss Harvesting Tips Physician On Fire

Using Market Volatility To Reduce Taxes A Case Study In Tax Loss Harvesting

Tax Loss Harvesting Definition Example How It Works

Tax Loss Harvesting How To Reap The Most Rewards Diligent Dollar

Year Round Tax Loss Harvesting Benefits Onebite

Do S And Don Ts Of Tax Loss Harvesting Zoe

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Tax Loss Harvesting Flowchart Bogleheads Org

What Is Tax Loss Harvesting Smarter Investing

Tax Loss Harvesting Napkin Finance

Top 5 Tax Loss Harvesting Tips Physician On Fire

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

What Is Tax Loss Harvesting Truist Invest

Tax Loss Harvesting Napkin Finance

Calculating The True Benefits Of Tax Loss Harvesting Tlh